2025 Tax Credits For Energy Efficiency 2025. The energy efficient home improvement tax credit, authorized through president biden’s inflation reduction act, provides taxpayers with financial incentives to obtain a home. Families who install an efficient electric heat pump for.

There’s also a $2,000 credit for heat pumps, heat pump water heaters and. For decades, the federal government has propped up energy sources and technologies through subsidies and tax credits.

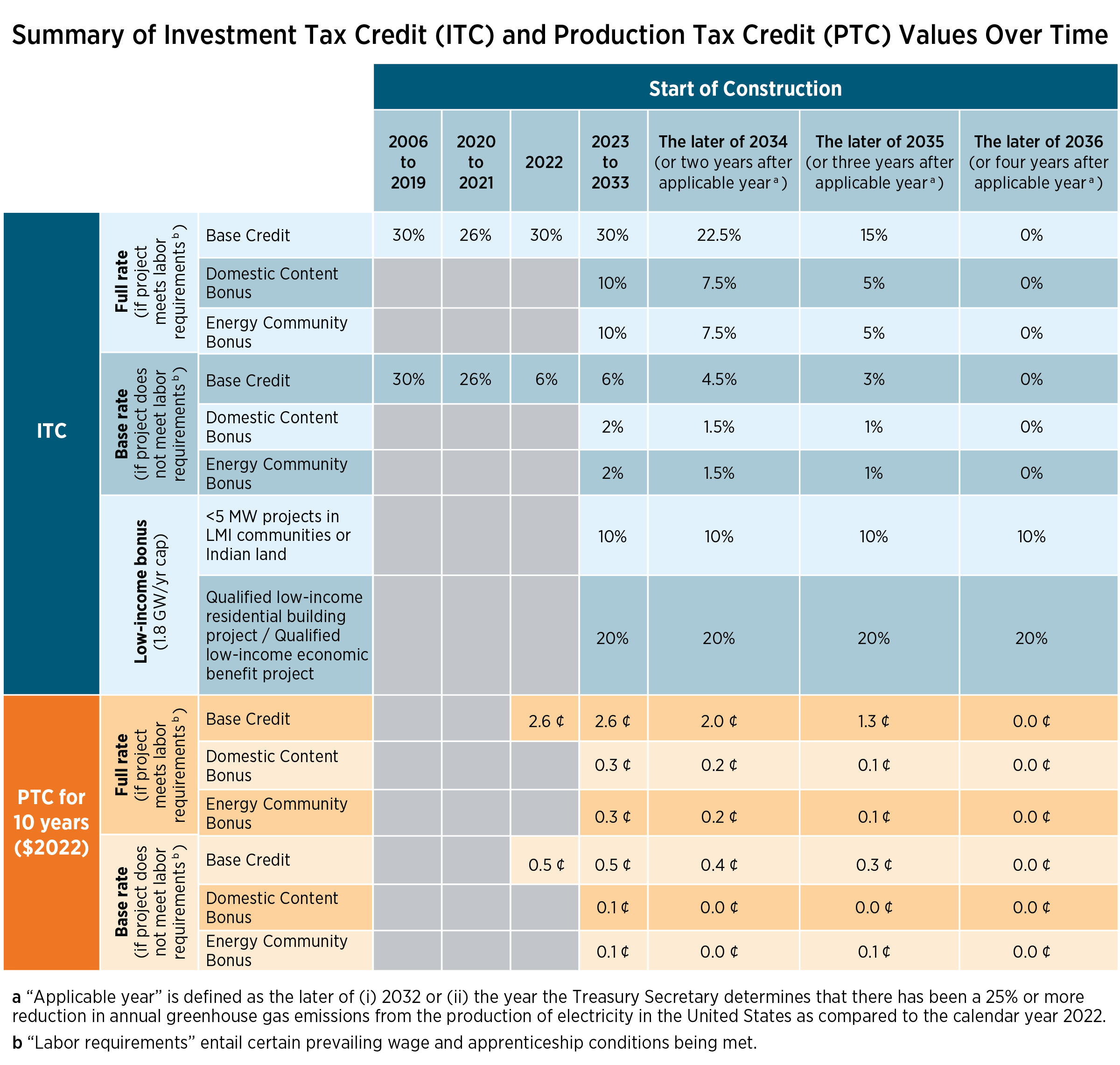

Energy Efficiency Tax Credits for 2025, On august 16th, 2022, the inflation reduction act of 2022 was passed, naming cee tiers as the basis for federal tax credits across several product categories through 2032.

Tax Credits for EnergyEfficient Home Improvements in 2025 Fixr, An explainer july 19, 2025 as part of president biden’s investing in america agenda, american families can lower their.

Tax Credits for EnergyEfficient Home Improvements in 2025 Fixr, There’s also a $2,000 credit for heat pumps, heat pump water heaters and.

Energy Efficiency Made Easy Understanding New Tax Credits and Benefi, Doe is offering new resources to support implementation of the home efficiency rebates (homes) program and has updated several resources to help states and territories.

How to Make the Most of Energy Efficiency Tax Credits in 2025, A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

GUIDE 2025 Federal Tax Credits for HVAC Systems Spurk HVAC, A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

Energy Efficient Home Improvement Credit Explained, Homeowners, including renters for certain expenditures, who purchase energy and other efficient appliances and products.

Tax Credits for Energy Efficiency Gundlach's Service, The maximum credit amount is $1,200 for home.

Inflation Reduction Act Energy Cost Savings Congressman Emanuel Cleaver, India's commitment to doubling energy efficiency is the central pillar of its plan to achieve nationally determined contributions (ndcs) under the paris agreement, which aims.

San Antonio businesses can take advantage of incentives by converting, Tax credits for solar panels and other products can reduce purchase costs.